With increasing passion for wealth generation and financial freedom, a good number of Indians are going for long and short-term investments in the stock market. Two of the most effective methods in this pursuit are investing in Mutual funds in India and venturing into Future trading. If done with planning and discipline, these methods can assist you in making a well diversified portfolio and earning heavy returns.

Mutual Funds in India

Mutual funds have become one of the most sought-after investment options for retail investors. They collect funds from a group of investors and invest in a diversified portfolio of stocks, bonds, or other securities under the direction of experienced fund managers.

Why Mutual Funds?

It is one of the prime reasons people prefer investing in Indian mutual funds. You don’t have to be a mathematician or a market expert to put your money into them. Rather, you leave it on the shoulders of experienced fund managers who invest your money in thoroughly analyzed assets.

There are several kinds of mutual funds to choose from—equity, debt, hybrid, and index funds—each designed to different risk tolerances and objectives. Whatever your reason for saving for retirement, your child’s education, or even just building your wealth over time, there is a mutual fund with a flexible, systematic solution.

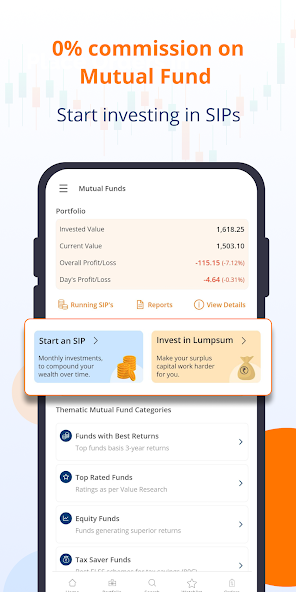

Monitor Your Investments with a Mutual Funds Tracker

These digital tools help you:

- Track your returns across different funds

- Compare past performance and fund ratings

- Monitor NAV (Net Asset Value) changes

- Plan SIPs (Systematic Investment Plans) more efficiently

By utilizing a mutual funds tracker, investors are able to stay updated and make better decisions based on market trends and individual financial objectives.

Starting Future Trading: Challenges for Seasoned Investors

Whereas mutual funds are low-risk, future trading has greater reward potential for risk-prone individuals. Futures are financial instruments that compel the buyer & seller to buy or sell, their asset at a point in time in the future and a fixed price. They are widely utilized in trading indices, stocks, and commodities.

Advantages of Future Trading

- Leverage: Futures enable you to own a big position for a relatively small amount of money.

- Hedging: Investors and traders can hedge their portfolios against market fluctuations.

- Speculation: You can earn returns from both increasing and decreasing markets.

Making Smart Investment Decisions with Stock Recommendations

Whether you’re investing in mutual funds or futures, keeping up with stock recommendations from credible analysts and financial platforms can offer valuable insights. These recommendations are based on technical analysis, market trends, and company fundamentals.

They can assist mutual fund investors in assessing the underlying stocks in their funds and aid prospective traders in identifying profitable entry and exit levels. Always cross-verify several sources and match the advice with your risk tolerance and objectives.

Conclusion

Creating wealth through savvy trading is all about knowing your investment pattern and connecting with the appropriate instruments. For those looking for stability and expert handling, Indian mutual funds are an excellent option. For seasoned traders, futures trading can help realize greater returns at greater risk. Employ tools such as a mutual funds tracker and keep yourself updated with good stock recommendations to make well-informed choices at every point.